Understanding Your Business Finances

A Practical Guide for Small Business Owners

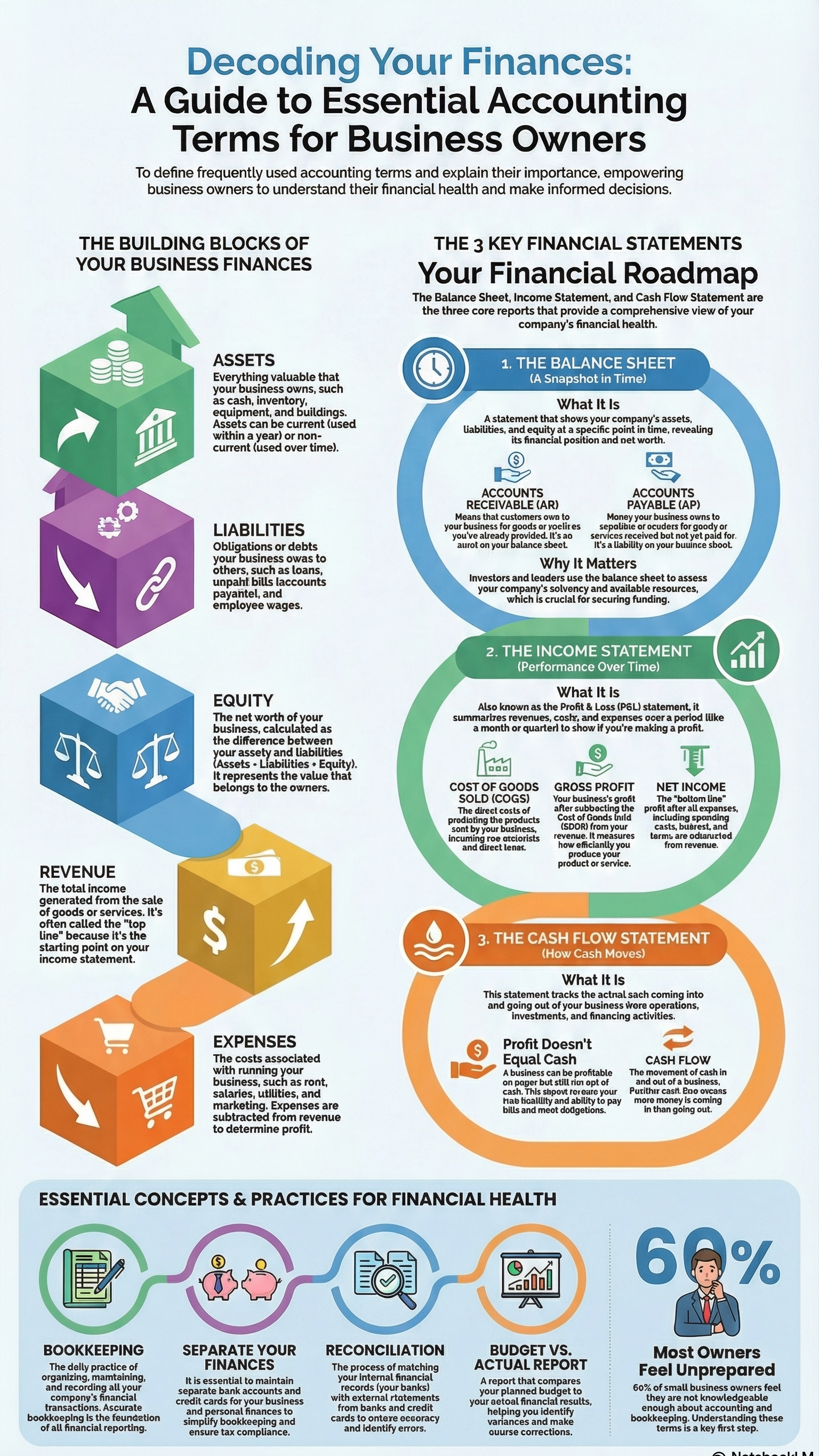

Most business owners don’t struggle because they’re bad at business — they struggle because they don’t have clear financial visibility. This guide explains the core building blocks of business finances, why they matter, and how they affect your day-to-day decisions.

Our goal is simple: help you replace confusion with clarity so you can make confident, informed decisions.

The Building Blocks of Your Business Finances

These are the five core elements every business is built on.

Assets — What Your Business Owns

Assets are the resources your business controls that have value. This includes cash in the bank, unpaid customer invoices (accounts receivable), inventory, equipment, and sometimes prepaid expenses or intellectual property.

Why this matters:

Assets tell you what your business can use to operate, grow, and survive slow periods. They show you whether your money is available or tied up elsewhere.

If this isn’t clear:

You may feel like your business is “making money” but still be short on cash. You may not realize your money is stuck in unpaid invoices or excess inventory until it creates stress.

Liabilities — What Your Business Owes

Liabilities are obligations your business must pay. This includes loans, credit cards, unpaid bills, payroll liabilities, and taxes owed.

Why this matters:

Liabilities represent financial pressure. They determine how much of your future cash is already spoken for.

If this isn’t clear:

You may get surprised by tax bills, loan payments, or vendor balances. Growth may feel heavier instead of easier because every new dollar is already committed.

Equity — What’s Left for the Owner

Equity is the difference between what your business owns and what it owes. It represents the value the business has built over time.

Why this matters:

Equity shows whether your business is getting stronger or just staying afloat. It’s also what creates long-term value.

If this isn’t clear:

You may be working hard without building a stable business underneath. You may withdraw too much or invest too little without realizing the long-term impact.

Revenue — Money Coming In

Revenue is the total money your business earns from selling products or services.

Why this matters:

Revenue shows demand and activity — but it does not show profitability or stability on its own.

If this isn’t clear:

You may celebrate sales growth while profitability quietly declines. You may confuse busyness with health.

Expenses — Money Going Out

Expenses are the costs of running the business: payroll, rent, software, marketing, supplies, and more.

Why this matters:

Expenses determine whether revenue becomes profit or disappears.

If this isn’t clear:

Money leaks go unnoticed, pricing becomes guesswork, and profit becomes accidental instead of intentional.

The Three Key Statements

These three reports work together to tell the full story of your business.

The Balance Sheet — Your Financial Snapshot

The Balance Sheet shows what your business owns (assets), what it owes (liabilities), and what’s left over (equity) at a specific moment in time.

Why it matters:

It shows the structure and stability of your business. It reveals hidden risks like too much debt, too little cash, or too much money tied up in receivables or inventory.

Without it:

You can’t see quiet problems until they become emergencies.

The Income Statement (P&L) — Your Profitability Scorecard

The Profit & Loss statement shows your revenue, expenses, and profit over a period of time.

Why it matters:

It shows whether your business is actually making money and where that money is going.

Without it:

You can’t tell if your pricing works, if growth is profitable, or which areas need adjustment.

The Cash Flow Statement — Your Survival Tracker

The Cash Flow Statement shows how cash actually moves in and out of your business through operations, investing, and financing.

Why it matters:

Cash is what pays bills. Cash flow is what keeps your business alive.

Without it:

You may look profitable on paper but still struggle to cover payroll, taxes, or rent.

Profit Is Not the Same as Cash

A business can be profitable and still run out of money.

This happens when:

Customers haven’t paid yet

Inventory or equipment uses up cash

Loan payments drain cash

Taxes haven’t been set aside

The owner withdraws too much

Profit shows performance. Cash shows survival.

You need both.

How These Pieces Work Together

The Income Statement shows how your business is performing.

The Cash Flow Statement shows whether that performance is sustainable.

The Balance Sheet shows whether your business is structurally strong.

When all three are clear, you gain:

Better decisions

Stronger profitability

Fewer financial surprises

More peace of mind

Final Thought

Financial clarity is not about becoming an accountant. It’s about being able to lead your business with confidence.

When you understand your numbers, you stop guessing.

When you stop guessing, you start building intentionally.

And that’s what creates both financial success and peace of mind.

"We're far from tech-savvy, and Lisette gave us valuable guidance on our shop's much-needed accounting makeover."

— Chef Randy