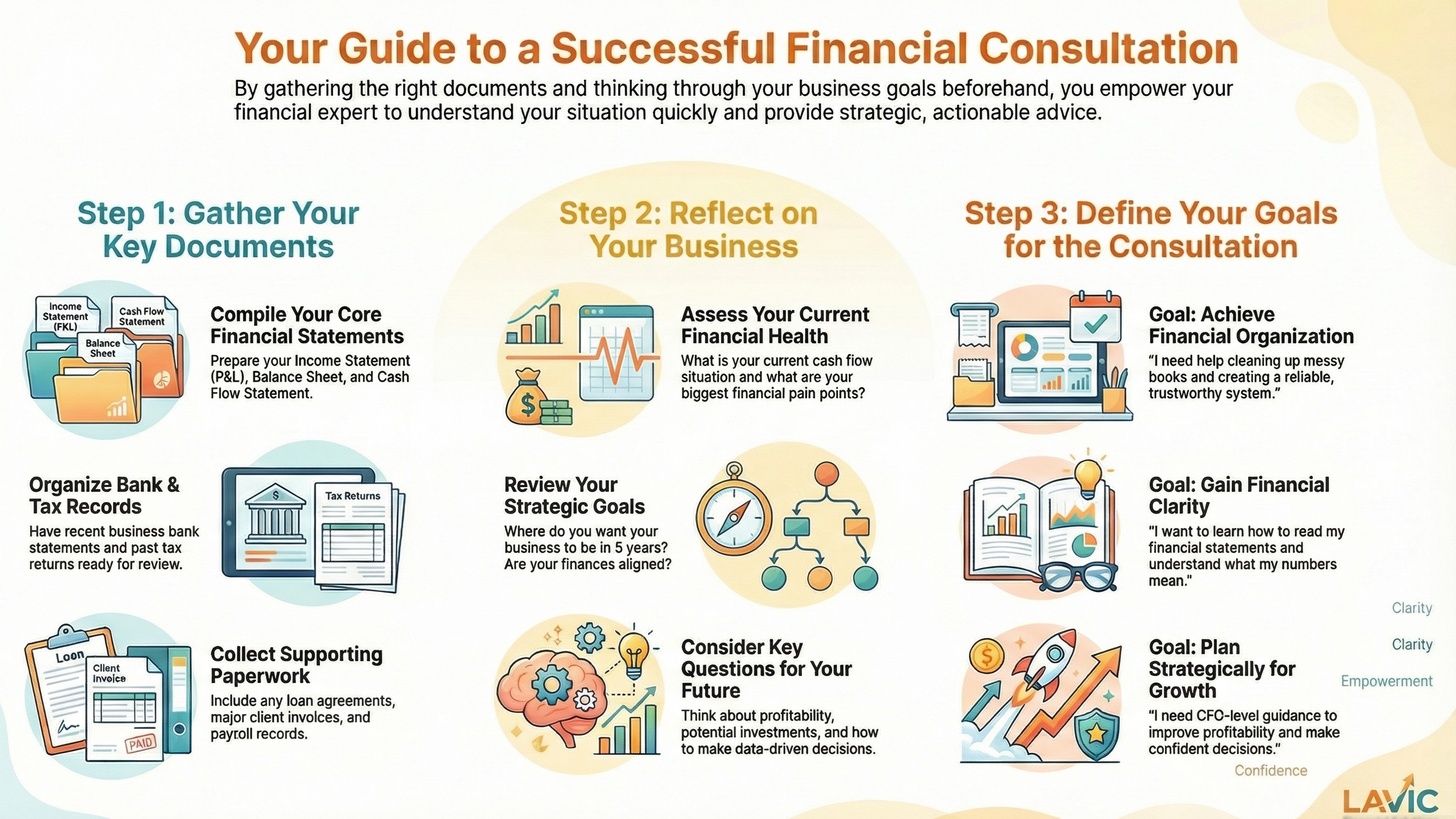

Your Guide to a Successful Financial Consultation

How to prepare so your consultation is clear, focused, and genuinely valuable

Step 1: Gather the Right Information

You do not need every document to move forward — but the more you bring, the more specific and helpful your consultation can be.

Helpful Documents (If Available)

Profit & Loss Statement (P&L)

Balance Sheet

Cash Flow Statement

Business bank and credit card statements

Tax returns (most recent year)

Loan or financing agreements

Payroll reports

Major client invoices or contracts

Why this matters:

These documents allow your advisor to understand how your business actually functions financially — not just how it feels.

If this isn’t clear:

The consultation stays high-level and general instead of tailored and actionable.

Step 2: Reflect Honestly on Your Business

Before the consultation, take a few minutes to reflect on where you truly are — not where you hope you are.

Ask Yourself:

Do I feel calm or stressed about my cash flow?

Do I know whether I’m profitable?

Do I trust my financial reports?

Where do I feel confused, stuck, or uncertain?

Why this matters:

Your answers guide the conversation. Without reflection, the consultation risks addressing symptoms instead of root causes.

Step 3: Clarify What You Want Help With

Clear intentions create clear outcomes.

Examples of Useful Goals:

“I need help cleaning up my books so I can trust my numbers.”

“I want to understand my financial statements so I can make better decisions.”

“I want to improve profitability and plan for sustainable growth.”

“I want to feel less anxious about my finances.”

“I’m preparing for a loan, investor, or expansion.”

Why this matters:

When you name your goals, your advisor can guide you instead of guess.

Step 4: Come with Questions

Your consultation is not a presentation — it’s a conversation.

Bring any questions that feel important, even if they feel basic:

“Why does my bank balance not match my profit?”

“Am I charging enough?”

“Can I afford to hire someone?”

“Where is my money actually going?”

There are no bad questions — only unasked ones.

What to Expect from the Consultation

A strong consultation will:

Review your current financial situation

Identify risks, gaps, and opportunities

Clarify what matters most right now

Recommend next steps

It is not a test. It is a collaborative process.

Final Thought

The purpose of preparation is not to impress — it’s to empower.

When you show up prepared:

The conversation becomes more specific

The guidance becomes more relevant

The outcome becomes more valuable

And you leave with clarity instead of confusion.

In Summary:

Prepare your documents.

Reflect honestly.

Clarify your goals.

Bring your questions.

That’s how you turn a consultation into a turning point.

A financial consultation is not about being judged — it’s about gaining clarity.

This guide will help you prepare thoughtfully so your consultation can focus on what matters most: understanding your current financial reality, identifying opportunities, and determining the right next steps for your business.

It’s not about being perfect. It’s about being prepared.

"Being an e-commerce entrepreneur isn't easy, and Adri gave my products the design direction they needed to become bestsellers."

— Sofia Pazari