A Small Business Owner’s Guide to Financial Clarity

How to move from financial stress to confident, informed leadership

Financial clarity is not about knowing everything — it’s about knowing what matters, understanding what you’re seeing, and using that information to lead your business with confidence.

This guide walks you through how financial clarity is built, what each layer supports, and why missing any layer creates stress, confusion, or risk.

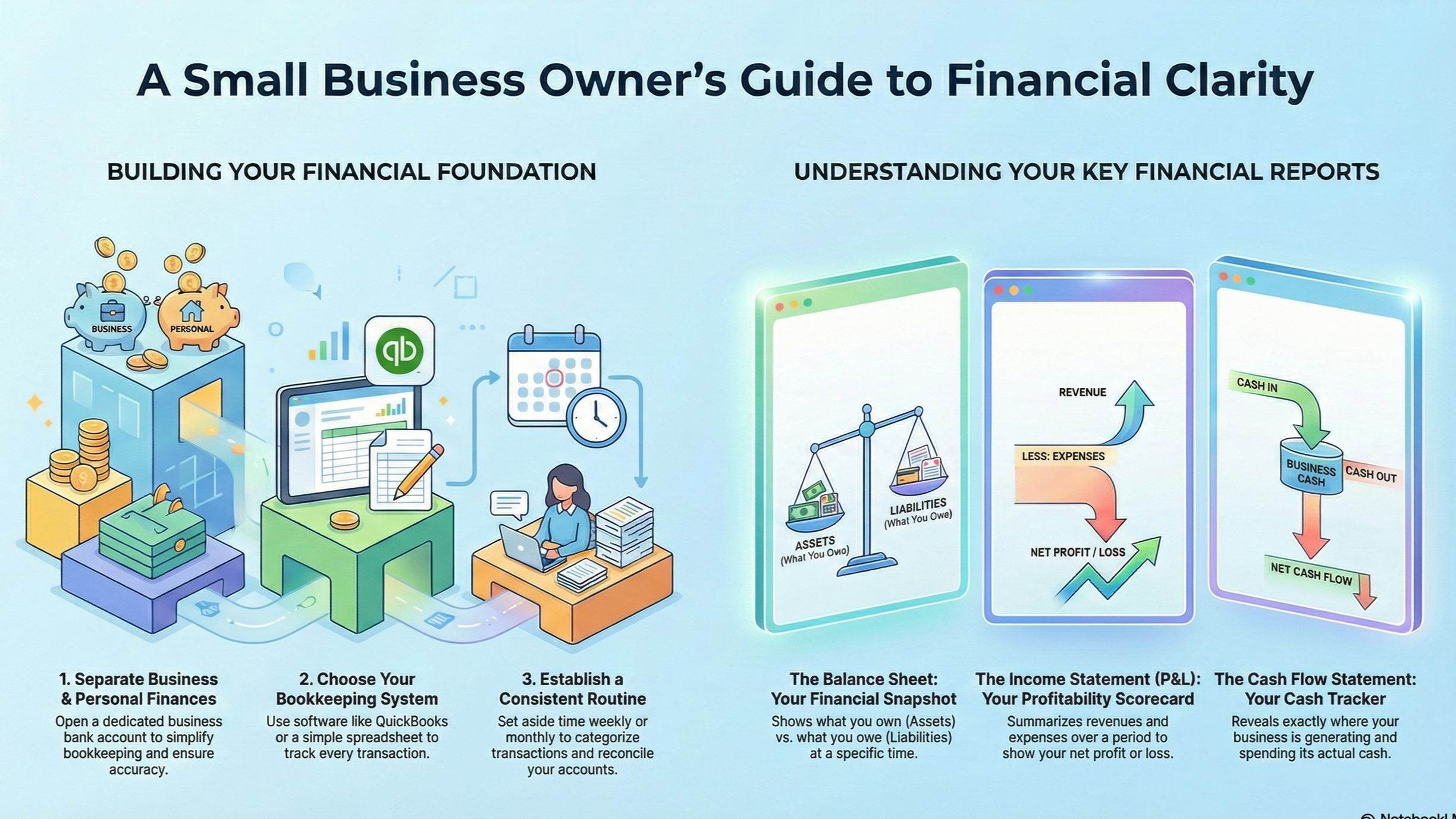

Level 1: Build Your Financial Foundation

Before strategy, forecasting, or growth, your business needs a stable foundation.

1. Separate Business and Personal Finances

Open a dedicated business bank account and credit card.

Why this matters:

Mixing finances makes it impossible to know what your business is truly earning or spending. It also increases legal, tax, and audit risk.

Without this:

Your reports become unreliable, your tax preparation becomes more expensive, and financial clarity becomes impossible.

2. Choose a Bookkeeping System

Use accounting software or a structured spreadsheet to track every transaction.

Why this matters:

Your system is the source of truth. If it’s inconsistent or incomplete, every report built on it becomes unreliable.

Without this:

You rely on memory, bank balances, or gut feelings instead of facts.

3. Establish a Consistent Routine

Reconcile and review your finances weekly or monthly.

Why this matters:

Consistency prevents small errors from becoming large problems.

Without this:

Books fall behind, clarity disappears, and financial anxiety grows.

Level 2: Understand Your Core Financial Reports

Once the foundation is stable, clarity comes from interpretation.

The Balance Sheet — Stability

Shows what your business owns, owes, and what’s left at a moment in time.

It answers:

Is my business financially stable?

Is my business carrying hidden risk?

The Income Statement — Profitability

Shows whether your business is actually making money.

It answers:

Is this business financially viable?

What is working and what isn’t?

The Cash Flow Statement — Survival

Shows how cash moves in and out.

It answers:

Can my business pay its bills?

Is growth creating strain or support?

Level 3: Use Financial Insight for Better Decisions

Clarity is only useful if it changes behavior.

Monitor Trends, Not Just Totals

Watch how revenue, expenses, margins, and cash change over time.

Understand Profitability

Know your break-even point, margins, and which services truly generate profit.

Align Finances With Growth

Ensure hiring, expansion, and investments are supported financially.

Level 4: Build a Smart Back Office

Your back office protects clarity.

Bookkeeping Methods

Understand cash vs accrual and why accuracy matters.

Software & Tools

Choose tools appropriate for your business size and complexity.

Best Practices

Separate accounts, reconcile monthly, store documents digitally, and follow consistent processes.

Level 5: Plan and Protect

Clarity also means looking forward.

Budgeting

Gives direction.

Tax Readiness

Prevents cash crises.

Audit Preparation

Protects your credibility.

Forecasting

Allows you to anticipate challenges before they arrive.

Final Reflection

Financial clarity is not about control — it’s about peace.

When your numbers are clear:

Decisions feel calmer

Risks feel manageable

Growth feels intentional

And your business becomes something you lead — not something you survive.

Summary

Clarity → Confidence → Better Decisions → Sustainable Success

That is the purpose of financial clarity.

"Lisette is so patient and thoughtful. She helped me Understand my Finances in a way that made me so clear in my financial decisions."

— Collette Noll